RISR Commentary for May, 2022

Performance Summary

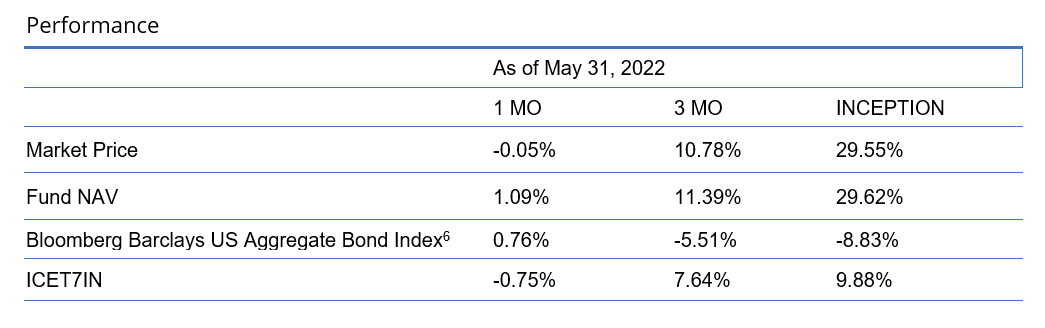

The FolioBeyond Rising Rates ETF (ticker: RISR) returned -0.05% based on closing market price (1.09% based on NAV) in May. In comparison, the ICET7IN Index (US Treasury 7 Year Bond Inversed Index) returned 0.75% while the Bloomberg Barclays U.S. Aggregate Bond Index ("AGG") returned 0.76% during the same time period.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling 866-497-4963. Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Returns beyond 1 year are annualized.

A fund's NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the fund was traded. The fund intends to pay out income, if any, monthly. There is no guarantee these distributions will be made.

Total Expense Ratio is 1.01%.

For most recent quarter-end and month-end standardized performance click here.

May Activity

Interest rate movements in May were highly volatile, as mixed messaging from a series of Federal Reserve officials led some market participants to conclude that inflation had peaked, and that the Fed would, therefore, move more slowly to increase rates. The 10-year Treasury note ended April at 2.9%, an increase of 55 bps from the start of the month. In the first week of May, this trend continued with rates peaking at 3.13%, until a sharp reversal took hold in the second week of May following dovish commentary and some economic data that was taken by the market as “it could have been worse.”

As a result, 10-year rates rallied almost 40 basis points, hitting an intra-month low of 2.74%. At the time, we communicated to the market, and to our investors, that this was a classic “head fake rally.” The kind of market moves that leave those trying to trade the short-term swings dazed and confused—and usually poorer. Under the circumstances, we were very pleased for RISR to have produced a positive return on NAV of a little over 1%. The fact that price declined a bit over the month was a function of the erosion of the premium of price to NAV of more than 1% that had characterized the fund for most of May. As fund managers we have no control over the premium or discount to NAV that RISR experiences. Growth in NAV and income are the metrics by which we measure our performance.

Despite the high degree of market volatility, we saw significant inflows in May. Our AUM increased by more than 50% during the month, and we ended May with total assets of $113.9MM. The percentage increase in AUM since the beginning of the year has been very gratifying. RISR is one of the fastest growing fixed income ETFs in the US.

We think this is occurring because our message is simple and impactful. We believe interest rates are going to go higher because they most likely have to. Inflation is literally “out of control,” as in the Fed no longer has control over spiraling prices for all manner of goods and services. If there was ever an opportunity to execute a gradual strategy of a handful of 25-50 basis point hikes, and then pause to see the impact, it is long past. If they don’t act aggressively, the Fed and other central banks around the world are going to lose all credibility, and therefore all influence over the course of inflation and financial market conditions.

The market gyrations in May are evidence of that very fact. Markets do not believe the Fed has the will to act decisively, and so the “buy the dip” mentality remains intact. Unfortunately for investors who continue to not recognize that we are in a new paradigm, those types of strategies are likely to fail. RISR, will continue to deploy new capital as we have since we launched the ETF. We identify fairly-valued MBS interest-only securities, targeting a negative duration of 10 years for our portfolio overall.

While there is some volatility in this metric from day-to-day and week-to-week, on a smoothed rolling average basis, so far this year, our so-called “empirical duration,” (i.e. what we observe in actual market movements rather than what is produced by a statistical model) has been very close to our target. We have had additional return contributions from security selection (we have been able to buy bonds at prices below fair value) and mortgage backed securities (MBS) spread tightening.

As we have noted in the last several commentaries, the housing and mortgage markets are showing signs of significant stress. The Mortgage Bankers Association’s index of new mortgage applications has collapsed to levels only seen three times since 2000, and the index has fallen by 70% from the post-Covid high seen at the beginning of 2021. The recent explosion in housing prices that has put homes out of reach for millions of prospective homebuyers ought to be deflating, but severe supply shortages, especially for lumber and other materials, has caused a shortage of new homes, which has been a support for home prices generally, and especially for rents. In short, with tight inventories, ever increasing mortgage rates, and very complex demographic patterns the US housing market is a jumble of conflicting trends and extremely difficult signals. A recent report published by housing giant Zillow noted that:

Buying a home in today's competitive market can be a stressful experience, often most similar to the stress of planning a wedding or being fired. A new Zillow survey shows 50% of home buyers say the process left them in tears, with Gen Zers and millennials — many of whom are first-time home buyers — far more likely to cry at least once during their home-buying journey. More than 65% of Gen Z buyers and 61% of millennial buyers cried at least once when going through the process of purchasing their home.

Additionally, some buyers planning to finance their purchase with a home loan are losing out to others who are able to pay entirely in cash, which is seen as a more attractive offer to a seller, since they don't need to worry about the sale falling through in the financing stage. According to Zillow's survey, nearly 30% of recent buyers said they lost to an all-cash buyer at least once.1

As we noted in prior commentaries, these stresses, combined with higher interest rates for those lucky few who can find a home and qualify for a mortgage, work to slow prepayments. This is the main driver of RISR’s return. As prepayments slow down, our interest only mortgage-backed-securities (MBS IOs) receive cash flow for a longer period of time. More cash flow means higher values for our IO investments.

Portfolio Applications

We believe RISR provides an attractive, thematic strategy that provide strong correlation benefits for both fixed income and equity portfolios. It can be utilized as part of a core holding for diversified portfolios or as an overlay to manage the interest rate risk of fixed income portfolios. Alternatively, RISR can be used as a macro hedge against rising interest rates with less exposure to equity beta and negative correlation to fixed income beta. The underlying bonds are all U.S. agency credit that are guaranteed by FNMA, FHLMC or GNMA. There is no financing leverage or explicit short positions that relies on borrowed securities. Also, timing is on our side as the strategy generates current income if interest rates were to remain within a trading range.

Please contact us to explore how RISR can be utilized as a unique tool to adjust your portfolio allocations in the current inflationary environment.

| Yung Lim | Dean Smith | George Lucaci |

|---|---|---|

| Chief Executive Officer | Chief Strategist and Marketing Officer | Global Head of Distribution |

| Chief Investment Officer | RISR Portfolio Manager | |

| ylim@foliobeyond.com | dsmith@foliobeyond.com | glucaci@foliobeyond.com |

| 917-892-9075 | 914-523-2180 | 908-723-3372 |

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, please call (866) 497-4963 or visit our website at www.etfs.foliobeyond.com. Read the prospectus or summary prospectus carefully before investing.

Investments involve risk. Principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge fund risks. The value of MBS IOs is more volatile than other types of mortgage related securities. They are very sensitive not only to declining interest rates, but also to the rate of prepayments. MBS IOs involve the risk that borrowers may default on their mortgage obligations or the guarantees underlying the mortgage-backed securities will default or otherwise fail and that, during periods of falling interest rates, mortgage-backed securities will be called or prepaid, which may result in the Fund having to reinvest proceeds in other investments at a lower interest rate.

The Fund’s derivative investments have risks, including the imperfect correlation between the value of such instruments and the underlying assets or index; the loss of principal, including the potential loss of amounts greater than the initial amount invested in the derivative instrument. The value of the Fund’s investments in fixed income securities (not including MBS IOs) will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned indirectly by the Fund. Please see the prospectus for a complete description of principal risks.

Diversification does not eliminate the risk of experiencing investment losses.

Footnotes

1http://zillow.mediaroom.com/2022-06-02-Half-of-Americans-cry-at-least-once-while-buying-a-home

Index Definitions

Bloomberg Barclays US Aggregate Bond Index: A broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

US Treasury 7-10 Yr Bond Inverse Index: ICE U.S. Treasury 7-10 Year Bond 1X Inverse Index is designed to provide the inverse of the daily return of the ICE U.S. Treasury 7-10 Year Bond Index (IDCOT7). ICE U.S. Treasury 7-10 Year Bond Index tracks the performance of US dollar denominated sovereign debt publicly issued by the US government in its domestic market. Qualifying securities of the underlying index must have greater than or equal to seven years and less than 10 years remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and an adjusted amount outstanding of at least $300 million.

Mortgage Bankers Association Index: The MBA’s Weekly Applications Survey offers a comprehensive analysis of mortgage application activity. The analysis includes reports on the state of purchase, refinance, conventional and government mortgage application data as well as indices covering various types of mortgages (Source: mba.org)

Definitions

Alpha: a return achieved above and beyond the return of a benchmark or proxy with a similar risk level.

Basis Points (bps): Is a unit of measure used in quoting yields, changes in yields or differences between yields. One basis point is equal to 0.01%, or one one-hundredth of a percent of yield and 100 basis points equals 1%.

Beta measures: the volatility of a security or portfolio relative to an index. Less than one means lower volatility than the index; more than one means greater volatility.

Coupon: is the annual interest rate paid on a bond, expressed as a percentage of the bond’s face value.

Convexity: A measure of how the duration of a bond changes in correlation to an interest rate change. The greater the convexity of a bond the greater the exposure of interest rate risk to the portfolio.

CUSIP: An identifier number that stands for the Committee on Uniform Securities Identification Procedures assigned to stocks and registered bonds in the United States and Canada.

Duration: measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

GNMA: Government National Mortgage Association

FNMA: Federal National Mortgage Association

FHLMC: Federal Home Loan Mortgage Corporation

Short Investment (Shorting): is a position that has been sold with the expectation that it will decrease in value, the intention being to repurchase it later at a lower price.

Distributed by Foreside Fund Services, LLC.