RISR Commentary for May 2024

Click here for a pdf version of this commentary.

Performance Summary

The FolioBeyond Alternative Income and Interest Rate Hedge ETF (ticker: RISR) returned 0.75% based on the closing market price (0.39% based on net asset value or “NAV”) in May. In comparison, the ICET7IN Index (US Treasury 7-Year Bond Inverse Index) returned -1.80% while the Bloomberg Barclays U.S. Aggregate Bond Index ("AGG") returned 1.70% during the same period.

May was one of only a handful of months in which RISR’s total return performance moved in the same direction as the broad bond markets. Typically, RISR “zigs” when the rest of the market “zags.” This is because our MBS IO portfolio is designed to increase in value as rates increase, which typically drives bond prices down. Last month, however, despite a general fall in interest rates, our current income outweighed the decline in IO prices seen during the month. This illustrates the benefits of having a high rate of current income in dampening overall return volatility.

The seemingly relentless rise in interest rates since the beginning of the year took a pause in May. By mid-month, the 10-year Treasury Bond yield fell by 34 bps, only to then reverse course, once again. At month end, the yield stood at 4.5% which was almost the exact middle of the trading range of the month.

10-year US Treasury Yield

The month began with the Fed announcing no change in the Federal Funds rate on May 1, but the catalyst for the rally came 2 days later when a weaker than expected employment report showed new jobs added of only 175,000 vs. the 240,000 expected, and far below the 310,000 from April. In addition, the unemployment rate tic’d up to 3.9%, which continued a modest a but sustained upward trend since the low point of 3.4% seen back in January. This very mild “normalizing” of the labor market was taken as a sign by the market, that rate cuts were back on the table, even though Fed Chairman Powell had taken them off the table just 2 days prior at his press conference. It is worth noting, however, that as he frequently does, Powell’s statements were a mixed bag of threats and promises, that left many observers confused. So, when the job numbers hit the tape, the markets reacted to the lack of credibility they held for the Fed’s words. There can be little doubt that this long-standing lack of credibility, amplified by poor messaging, has made the Fed’s job tougher.

Unemployment Rate

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling 866-497-4963. Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Returns beyond 1 year are annualized.

A fund's NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the fund was traded. The fund intends to pay out income, if any, monthly. There is no guarantee these distributions will be made.

Total Expense Ratio is 1.13%.

For standardized performance click here.

Outlook

Inflation as reported by the official government statistics is a funny thing. First, of all, there is no single number that can capture the full range of price changes for the millions of products and services consumers and firms buy each month. The “headline” Consumer Price Index (CPI) is—at best—a crude measure of price increases for households. Even trying to define a representative household’s monthly purchases is a fraught exercise. Likewise, the Producer Price Index (PPI) may be even worse, given the diversity of businesses in the economy and the impossibility of determining a representative basket of goods and services purchased by businesses across the country. There are countless other measures of inflation including the Personal Consumption Expenditure (PCE) index, which some Fed watchers claim is their preferred measure. The Federal Reserve Bank of Atlanta, which maintains the FRED economic database, includes several thousand variations of inflation statistics.

Any inflation measure must also keep track of changes in quality that occur over time, not just prices paid. For instance, the car of 2024 is a far cry from the car of 1994, and these so-called hedonic adjustments for changes in quality, utility and functionality are very complex and unavoidably subjective. Then there are substitution effects that change the composition of the basket over time. For example, as prices for beef increase consumers may buy less beef and switch to chicken. Keeping track of, and incorporating, such changes in an inflation measure are fiendishly difficult. There is also noise in the data, because the methods the government use to obtain and sample prices are imprecise and somewhat variable.

Finally, the time frame in which inflation is measured makes a great deal of difference. Inflation data are published each month, but even in a period of moderate inflation, the monthly changes are often very small, on the order of 0.3%. When looked at from a longer time frame, these seemingly small changes accumulate and compound.

For some time now, government officials, especially those in the President’s political party have been arguing that inflation is largely under control by pointing to these small and declining month-over-month changes. Much of the mainstream press has supported this viewpoint. The other party, not surprisingly, takes the opposite view.

This debate really misses the point, however. Consumers and most businesses do not experience inflation in this way. Instead, they are more likely to take a longer term view, and compare the price level today with the level at some earlier point in time, that could be several quarters or even years. From this perspective, inflation is still having a significant effect on consumer and business behavior.

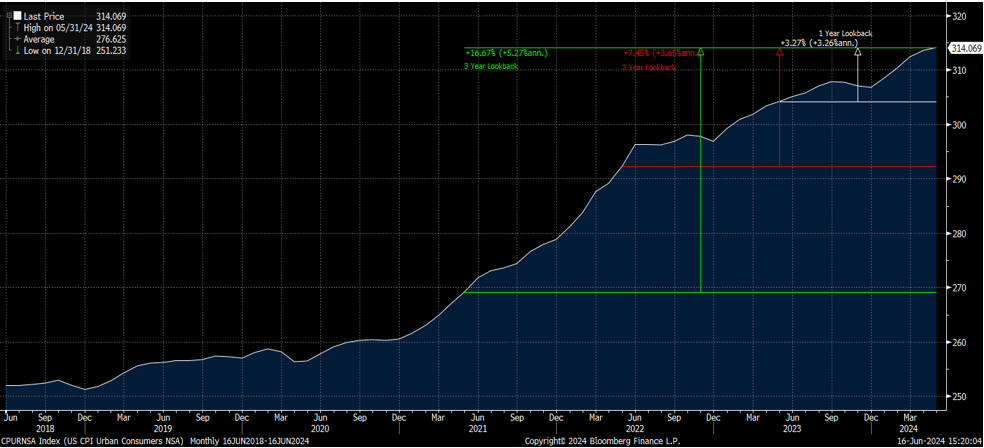

The graph below illustrates the problem. The white line plots the actual level of prices, as measured by the CPI. This is not the inflation rate, but the actual price level captured by the index. If we look at the change in the index over a 1-year period, we get the familiar 3+% headline that has been reported recently. Still far above the Fed’s 2% target, but well below the readings from 2021 and 2022.

There is nothing magical or special about a 1-year lookback. What if we consider the change in the price level looking back two years or even three years. These are well within the memory of most households and businesses. Here we see that the “inflation rate” measured on a longer horizon is much higher: almost 7.5% over two years, and almost 17% over three years. There is no point in telling households and businesses they need to stop complaining about annual inflation that is “only” 3%, as some politicians and pundits have tried to do. These economic actors clearly recognize that their spending power has declined materially over the very recent past. Referring to the chart, we can see that a basket of goods that cost $270 three years ago now costs over $314. That is how inflation “feels” to them.

Consumer Price Index

This impression is further heightened by the sharp increases in many goods and services that are only purchased occasionally. For instance, rent renewals, insurance premiums, and major appliances, are not purchased a little bit each month. In many cases, the current price is far above the price paid two or three years ago, and consumers and business are absolutely correct in perceiving that as current inflation. Again, there is no rule that says 12 months is the relevant or correct period for measuring economic perceptions and behaviors. Finally, the representative basket of goods and services is a convenient fiction. Every household and business is different, and changes in relative prices will affect parties very differently depending their specific basket, and level of overall prosperity.

For these reasons, despite the general slowing of inflation by most measures economists use, the polls report that households and businesses overall still say that inflation is in the top handful of issues that concern them. And, as we discussed in a prior note, the cumulative difference between 3-3.5% 12-month lookback inflation and the Fed’s 2% target is highly significant over time.

For these reasons, and more, it is still safe to say that the Fed will not be executing a large number of rate cuts in 2024. The so-called “market implied” 4-6 rate cuts some had been forecasting earlier this year were always fanciful. And even if the Fed begins to ease later this year, there is no reason to believe that will quickly lead to materially lower rates for longer maturities, including for mortgage rates.

This means that the rates most investors actually should care about—5 year, 10 year and longer—will continue to be higher than recent history, and there can be no assurance that we won’t test the recent highs if we get another hot CPI, PPI and payroll number. For that reason, RISR is designed to have a negative duration, which means it tends to zig when other parts of the market zag. Therefore, by adding RISR to an existing portfolio, investors may be able to reduce their overall duration profile, and can offset some of the heightened volatility in the market. And it can do so while generating an attractive and consistent dividend yield.

Please contact us to explore how RISR might fit into your overall strategy, to help you manage risk while generating an attractive current yield.

Portfolio Applications

We believe RISR provides an attractive, thematic strategy that provides strong correlation benefits for both fixed income and equity portfolios. It can be utilized as part of a core holding for diversified portfolios or as an overlay to manage the interest rate risk of fixed income portfolios. Alternatively, RISR can be used as a macro hedge against rising interest rates with less exposure to equity beta and negative correlation to fixed income beta. The underlying bonds are all U.S. agency credit that are guaranteed by FNMA, FHLMC or GNMA. Also, timing is on our side as the strategy generates current income if interest rates were to remain within a trading range.

Please contact us to explore how RISR can be utilized as a unique tool to adjust your portfolio allocations in the current inflationary environment.

| Yung Lim | Dean Smith | George Lucaci |

|---|---|---|

| Chief Executive Officer | Chief Strategist and Marketing Officer | Global Head of Distribution |

| Chief Investment Officer | RISR Portfolio Manager | |

| ylim@foliobeyond.com | dsmith@foliobeyond.com | glucaci@foliobeyond.com |

| 917-892-9075 | 914-523-2180 | 908-723-3372 |

This material must be preceded or accompanied by a prospectus. For a copy of the prospectus please click here.

Investments involve risk. Principal loss is possible. Unlike mutual funds, ETFs trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge fund risks. The value of MBS IOs is more volatile than other types of mortgage related securities. They are very sensitive not only to declining interest rates, but also to the rate of prepayments. MBS IOs involve the risk that borrowers default on their mortgage obligations or the guarantees underlying the mortgage-backed securities will default or otherwise fail and that, during periods of falling interest rates, mortgage-backed securities will be called or prepaid, which result in the Fund having to reinvest proceeds in other investments at a lower interest rate.

The Fund’s derivative investments have risks, including the imperfect correlation between the value of such instruments and the underlying assets or index; the loss of principal, including the potential loss of amounts greater than the initial amount invested in the derivative instrument. The value of the Fund’s investments in fixed income securities (not including MBS IOs) will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned indirectly by the Fund. Please see the prospectus for a complete description of principal risks.

Diversification does not eliminate the risk of experiencing investment losses.

Index Definitions

Bloomberg Barclays US Aggregate Bond Index: A broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

US Treasury 7-10 Yr Bond Inversed Index: ICE U.S. Treasury 7-10 Year Bond 1X Inverse Index is designed to provide the inverse of the daily return of the ICE U.S. Treasury 7-10 Year Bond Index (IDCOT7). ICE U.S. Treasury 7-10 Year Bond Index tracks the performance of US dollar denominated sovereign debt publicly issued by the US government in its domestic market. Qualifying securities of the underlying index must have greater than or equal to seven years and less than 10 years remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and an adjusted amount outstanding of at least $300 million.

S&P 500 Index: The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

IBOXHY Index: iBoxx USD Liquid High Yield Total Return Index measures the USD denominated, sub-investment grade, corporate bond market. The index includes bonds with minimum 1 years to maturity,

minimum amount outstanding of USD 400 mil. Bond type includes fixed-coupon, step-up, bonds with

sinking funds, medium term notes, callable and putable bonds.

Definitions

Alpha: a return achieved above and beyond the return of a benchmark or proxy with a similar risk level.

Annualized Equivalent Yield: represents the annualized yield based on the most recent month of income distribution: (income distribution x 12 months)/price per share.

Basis Points (bps): Is a unit of measure used in quoting yields, changes in yields or differences between yields. One basis point is equal to 0.01%, or one one-hundredth of a percent of yield and 100 basis points equals 1%.

Beta measures: the volatility of a security or portfolio relative to an index. Less than one means lower volatility than the index; more than one means greater volatility.

Convexity: A measure of how the duration of a bond changes in correlation to an interest rate change. The greater the convexity of a bond the greater the exposure of interest rate risk to the portfolio.

Correlation: a statistic that measures the degree to which two securities move in relation to each other.

Coupon: is the annual interest rate paid on a bond, expressed as a percentage of the bond’s face value.

CUSIP: An identifier number that stands for the Committee on Uniform Securities Identification Procedures assigned to stocks and registered bonds in the United States and Canada.

Duration: measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

GNMA: Government National Mortgage Association

FNMA: Federal National Mortgage Association

FHLMC: Federal Home Loan Mortgage Corporation

Short Investment (Shorting): is a position that has been sold with the expectation that it will decrease in value, the intention being to repurchase it later at a lower price.

Distributed by Foreside Fund Services, LLC.