RISR Commentary for March 2024

Click here for a pdf version of this commentary.

Performance Summary

The FolioBeyond Alternative Income and Interest Rate Hedge ETF (ticker: RISR) returned -0.73% based on the closing market price (-0.44% based on net asset value or “NAV”) in March. In comparison, the ICET7IN Index (US Treasury 7-Year Bond Inverse Index) returned -0.74% while the Bloomberg Barclays U.S. Aggregate Bond Index ("AGG") returned 0.92% during the same period.

Interest rates ended the month basically where they started, as markets waited in vain for some clarity on the timing for Federal Reserve action. The first half of the month saw a modest decline, but it was without conviction. Rates then rebounded higher following several reports showing continued strength in the labor market. So, despite public statements from a variety of Fed officials that policy could possibly begin to ease at “some point” in 2024, strong economic indicators once again pushed back on that timeline. In all, it was a month of churning in rates, even as stocks continued to grind higher based on the seemingly relentless rise in a handful of tech shares, a theme to which we will return below.

For technical reasons, mortgage spreads tightened during the month. This included a significant revision to a widely-used industry prepayment model called YieldBook. The net effect of these model changes was meaningful reduction in projected option adjusted spreads (OAS) for much of the existing agency MBS universe. Our portfolio on MBS interest-only securities (MBS IOs) tend to decline in value as OAS tighten, so this had the effect of driving modest mark-to-market declines in many of our positions. The good news is this is likely to be a one-time event. In addition, the yield curve flattened (long-term rates declined more than short-term rates) during the month, which also has dampening effect on mortgage spreads as well as on MBS IO prices. As we have explained in prior communications, IOs increase (decrease) in value when prepayments are expected to slow down (speed up). Anything that causes effective mortgage rates, or equivalently mortgage spreads to risk-free rates, to decline has the effect of increasing projected prepayment speeds which, other things being held constant, tends to reduce IO values. In any case, the impact of these factors was relatively small, in the scheme of things, and our overall performance for March was close to unchanged.

Capital flows were likewise uneventful, with one unit created and two units redeemed, leaving our overall assets close to unchanged.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling 866-497-4963. Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Returns beyond 1 year are annualized.

A fund's NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the fund was traded. The fund intends to pay out income, if any, monthly. There is no guarantee these distributions will be made.

Total Expense Ratio is 1.13%.

For standardized performance click here.

Outlook

This tightening cycle by the Fed, which started back in Q1 2022, is beginning to feel like a siege. A large share of market participants, and many folks in Washington just want it to be over. Therefore, Fed chair Powell can perhaps be forgiven for hinting in his public communications that we may be closer to the end of the cycle than we are to the beginning. But “closer” does not mean we are “close.”

Historically, a siege ends in one of two ways: Either the subjects of the siege surrender, or an outside army rescues them. If we can continue the metaphor, inflation has to succumb to higher rates, i.e. to surrender and decline to the Fed’s 2% target, or else some outside shock--typically coming from the supply side-- has to impact the economy so significantly that that prices cease rising. Neither outcome is immediately evident.

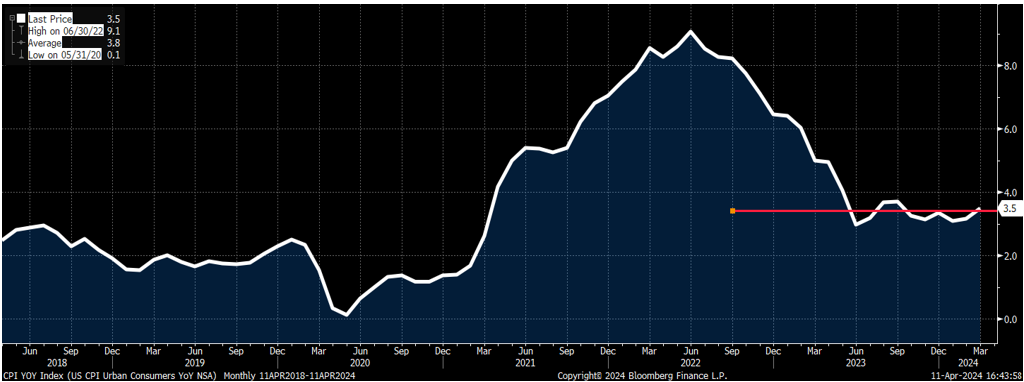

Inflation has basically stopped falling for some time. The chart below shows no meaningful change since June 2023, fully 9 months ago. We’ve been stuck around 3.5% for three quarters. This is well above the Fed’s 2% target.

Nitpickers will quibble that the Fed isn’t focused on the Consumer Price Index (“CPI”), but instead on some more obscure core-PCE index. But the American households do focus on CPI; that is to say, they live it. That index reflects the basket of goods and services they buy every day. And that measure of inflation stopped declining a long time ago. Neither the PCE nor the CPI is a perfect measure, but the fact is that CPI hasn’t budged. Until this measure declines materially from its current level, the Fed will not be able to believably declare the end of the siege.

The second option for ending the inflation siege—an exogenous shock—can never be ruled out. But as of now, the potential candidates for an economic shock are moving in the other direction. These include geo-political crises, commodity prices, (especially oil) and now we have to consider technology. Specifically, we need to consider the impacts of Artificial Intelligence, or AI.

Like many previous technological innovations, such as the steam engine, AI has the potential to increase labor productivity. Over time, this can have a deflationary effect, but in the near term the opposite is more likely to be the case. The demands that AI will place on economic resources may put significant stress on various inputs, and increase inflationary pressure, not reduce it.

Take the need for micro-processors. Currently, TSMC, a Taiwanese company, and American chipmaker NVDIA between them produce the bulk of the chips used in all AI computing applications around the world. There is, however, a massive supply/demand imbalance between chip-making capacity and global demand. The most recent innovations coming from firms like OpenAI, and Anthropic are the large language models (LLMs) that require tens of thousands of graphics processors (GPUs) to train. In the very near future, we will see AI applications that require more than 10x that number. Over the balance of this decade, industry projections are for demand growth of around 35% per year just for GPUs.

Chip-making capacity is extraordinarily expensive to add, generally costing on the order of $10bn per facility, with projections that the next generation of fabs may cost $25bn or more to construct. A fabrication facility can take years before it can produce consistently high-quality chips. In addition, there is a severe shortage of trained engineers and technicians to staff these “fabs.” The Biden administration has delivered a package of incentives to add fab capacity in the US, but the lack of trained workers has hamstrung that effort. Several previously announced projects have been cancelled for this reason. In short there is going be a need for many billions in investment capital for technology related construction and manufacturing.

The second AI-related shock is going to come from energy consumption. Already, several regional electrical grids have come under stress from the demand for energy to supply the companies running these massive LLMs and other AI programs. The International Energy Agency projects that data-center, AI, and crypto mining electricity demand is set to rise from around 500 terra watt hours (Twh) to more than 1,000 Twh over the next two years. That is around the annual electricity consumption of a country the size of Germany. No one has put forth a credible plan to produce that much generation capacity, without a massive capital expenditure. And the demand will continue to grow from there.

In short, the macro-economic demands from technology over the next 10+ years are likely to increase inflationary pressures, not mitigate them. We continue to believe there is likely to be quite some time before the fight against inflation will be fully won. Fed Chair Powell has said so repeatedly, and the data support this. It is far too soon for most investors to add duration, or position portfolios for lower volatility. Risk management remains the paramount objective.

RISR is designed to have a negative duration, which means it tends to zig when other parts of the market zag. Therefore, by adding RISR to an existing portfolio, investors may be able to reduce their overall duration profile, and can offset some of the heightened volatility in the market. And it can do so while generating an attractive consistent dividend yield.

Please contact us to explore how RISR might fit into your overall strategy, to help you manage risk while generating an attractive current yield.

Portfolio Applications

We believe RISR provides an attractive, thematic strategy that provides strong correlation benefits for both fixed income and equity portfolios. It can be utilized as part of a core holding for diversified portfolios or as an overlay to manage the interest rate risk of fixed income portfolios. Alternatively, RISR can be used as a macro hedge against rising interest rates with less exposure to equity beta and negative correlation to fixed income beta. The underlying bonds are all U.S. agency credit that are guaranteed by FNMA, FHLMC or GNMA. Also, timing is on our side as the strategy generates current income if interest rates were to remain within a trading range.

Please contact us to explore how RISR can be utilized as a unique tool to adjust your portfolio allocations in the current inflationary environment.

| Yung Lim | Dean Smith | George Lucaci |

|---|---|---|

| Chief Executive Officer | Chief Strategist and Marketing Officer | Global Head of Distribution |

| Chief Investment Officer | RISR Portfolio Manager | |

| ylim@foliobeyond.com | dsmith@foliobeyond.com | glucaci@foliobeyond.com |

| 917-892-9075 | 914-523-2180 | 908-723-3372 |

This material must be preceded or accompanied by a prospectus. For a copy of the prospectus please click here.

Investments involve risk. Principal loss is possible. Unlike mutual funds, ETFs trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge fund risks. The value of MBS IOs is more volatile than other types of mortgage related securities. They are very sensitive not only to declining interest rates, but also to the rate of prepayments. MBS IOs involve the risk that borrowers default on their mortgage obligations or the guarantees underlying the mortgage-backed securities will default or otherwise fail and that, during periods of falling interest rates, mortgage-backed securities will be called or prepaid, which result in the Fund having to reinvest proceeds in other investments at a lower interest rate.

The Fund’s derivative investments have risks, including the imperfect correlation between the value of such instruments and the underlying assets or index; the loss of principal, including the potential loss of amounts greater than the initial amount invested in the derivative instrument. The value of the Fund’s investments in fixed income securities (not including MBS IOs) will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned indirectly by the Fund. Please see the prospectus for a complete description of principal risks.

Diversification does not eliminate the risk of experiencing investment losses.

Index Definitions

Bloomberg Barclays US Aggregate Bond Index: A broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

US Treasury 7-10 Yr Bond Inversed Index: ICE U.S. Treasury 7-10 Year Bond 1X Inverse Index is designed to provide the inverse of the daily return of the ICE U.S. Treasury 7-10 Year Bond Index (IDCOT7). ICE U.S. Treasury 7-10 Year Bond Index tracks the performance of US dollar denominated sovereign debt publicly issued by the US government in its domestic market. Qualifying securities of the underlying index must have greater than or equal to seven years and less than 10 years remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and an adjusted amount outstanding of at least $300 million.

S&P 500 Index: The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

IBOXHY Index: iBoxx USD Liquid High Yield Total Return Index measures the USD denominated, sub-investment grade, corporate bond market. The index includes bonds with minimum 1 years to maturity,

minimum amount outstanding of USD 400 mil. Bond type includes fixed-coupon, step-up, bonds with

sinking funds, medium term notes, callable and putable bonds.

Definitions

Alpha: a return achieved above and beyond the return of a benchmark or proxy with a similar risk level.

Annualized Equivalent Yield: represents the annualized yield based on the most recent month of income distribution: (income distribution x 12 months)/price per share.

Basis Points (bps): Is a unit of measure used in quoting yields, changes in yields or differences between yields. One basis point is equal to 0.01%, or one one-hundredth of a percent of yield and 100 basis points equals 1%.

Beta measures: the volatility of a security or portfolio relative to an index. Less than one means lower volatility than the index; more than one means greater volatility.

Convexity: A measure of how the duration of a bond changes in correlation to an interest rate change. The greater the convexity of a bond the greater the exposure of interest rate risk to the portfolio.

Correlation: a statistic that measures the degree to which two securities move in relation to each other.

Coupon: is the annual interest rate paid on a bond, expressed as a percentage of the bond’s face value.

CUSIP: An identifier number that stands for the Committee on Uniform Securities Identification Procedures assigned to stocks and registered bonds in the United States and Canada.

Duration: measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

GNMA: Government National Mortgage Association

FNMA: Federal National Mortgage Association

FHLMC: Federal Home Loan Mortgage Corporation

Short Investment (Shorting): is a position that has been sold with the expectation that it will decrease in value, the intention being to repurchase it later at a lower price.

Distributed by Foreside Fund Services, LLC.