RISR Commentary for July 2024

Click here for a pdf version of this commentary.

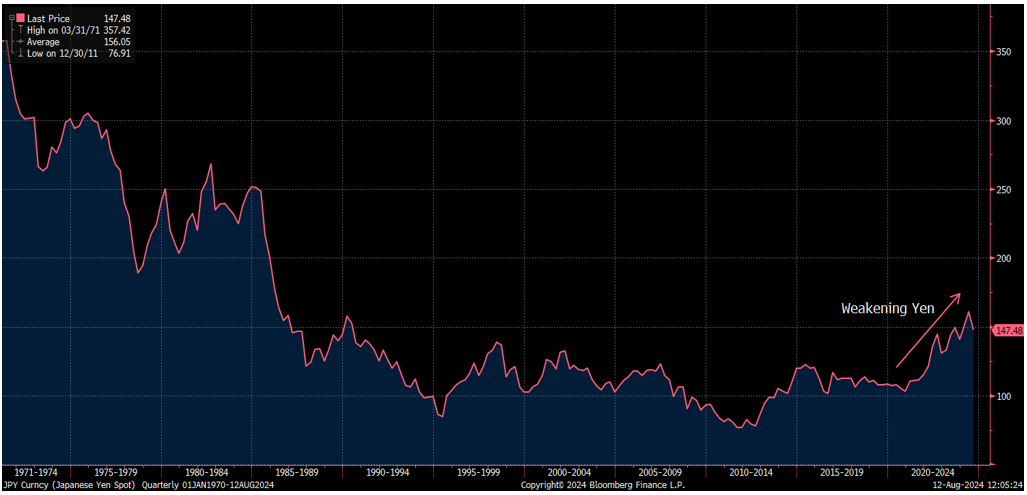

Performance Summary

The FolioBeyond Alternative Income and Interest Rate Hedge ETF (ticker: RISR) returned -0.20% based on the closing market price (-0.66% based on net asset value or “NAV”) in July. In comparison, the ICET7IN Index (US Treasury 7-Year Bond Inverse Index) returned -2.84% while the Bloomberg Barclays U.S. Aggregate Bond Index ("AGG") returned 2.34% during the same period.

During the past 23 months, RISR has paid monthly dividends of a least 0.18/share consistently, with a corresponding SEC yield ranging from approximately 6% to 9%+. The decline in interest rates that began in May accelerated in July, with the 10-year treasury yield falling by 40 basis points during the month. As July closed, that rate was within 23 bps of the recent cyclical low near the end of 2023. This amounts to a retracement of more than 2/3 of the increase that had occurred since the beginning of the year. Since the beginning of Q2, market consensus has been building that we have seen the highs for this rate cycle. It should be noted, however, that we have been here before. Since the Fed began raising the Federal Funds rate in March 2022, we have seen at least four significant treasury market rallies (declines in rates): Q2 2022, Q4 2022-Q1 2023, Q4 2023, and the most recent.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, June be worth more or less than their original cost and current performance June be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling 866-497-4963. Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Returns beyond 1 year are annualized.

A fund's NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the fund was traded. The fund intends to pay out income, if any, monthly. There is no guarantee these distributions will be made.

Total Expense Ratio is 1.13%.

For standardized performance click here.

RISR’s performance during the month, therefore, was more than satisfactory since it represents a total return that was only about 1.5x the move in rates. In other words, July was yet another month in which RISR’s total return fell less in a falling rate environment than it has tended to rise when rates have increased. The technical term for this is “positive convexity” and is a highly desirable property in any investment product. Moreover, RISR still exhibits “negative duration,” i.e. it moves in the opposite direction of standard fixed income investments in response to rate moves. It is fair to say that to our knowledge, investment products that have positive convexity and negative duration are very uncommon, and highly attractive for most investors.

It may be worth exploring the composition of the portfolio to help illuminate this return pattern. The table below shows the holdings on MBS IOs by vintage (year of origination), and coupon.

As the table shows, the largest concentrations of exposure are coupons between 3.5 and 4.5, originated between 2018 and 2020. These concentrations represent intentional choices to achieve the most attractive returns, as measured by option-adjusted spread, which is our preferred measure of risk-adjusted return.[1] MBS IOs backed by very low coupon mortgages are relatively less attractive because their prices tend to be insensitive to modest changes in market interest rates, since it would take a very large decline in rates to induce a change in prepayment incentives. To use the language of option pricing, they are said to be “out-of-the-money.” Contrariwise, MBS IOs backed by mortgages with high coupons tend to be highly sensitive to changes in market rates, because comparatively modest changes in market interest rates could induce larger changes in prepayment incentive. Such loans can be described as “in-the-money.” Since the inception of RISR, coupons in the range of 3.5-4.5% have been neither strongly in- or out-of-the-money, yet still have offered attractive returns. It is for this reason they predominate in the portfolio.

The selection of vintages between 2018 and 2020 arises for a similar reason. Loans originated many years ago exhibit what is sometimes referred to as “burn-out.” This means that the borrowers in these homes have exhibited a strong tendency not to move or prepay, despite changes in interest rates. At the other end of the spectrum, more recently originated loans, say, those originated in the most recent 12-24 months, tend to respond less strongly to prepayment incentive from rate changes because of how recently the borrower/homeowner obtained the loan, and the high fixed cost of refinancing in such a short time frame, among other technical reasons.

Having said that, we frequently find MBS IOs that provide an attractive OAS outside these broad boundaries. That may be for security structural reasons, or due to geographic or other fundamental factors. Our models look at each prospective investment on its own, and in the context of the overall portfolio. We do not have any hard inclusion or exclusion rules, but instead rely on a systematic evaluation of each individual security available in the marketplace.

The actual mathematical models we use in our proprietary valuation models are far more complex than this simplified description and incorporate many more fundamental and technical variables. But these factors and others have led to a portfolio dominated in the “sweet spot” seen in the table above. Investors with more specific questions about portfolio composition are invited to contact us directly. We would be pleased to answer any questions you may have about the securities held by the fund.

[1] Option-adjusted spread, or OAS, represents the return above a risk-free rate, after accounting for the value of prepayment option held by mortgage borrowers.

Outlook

Yield Curve

One of the under-reported market trends of the past several months has been the meaningful steepening of the yield curve. Even as yields overall dropped during July, short-term rates dropped more than long-term rates. Normally, long-term rates are higher than short-term rates, but since the Fed began its most recent rate hiking cycle, we have experienced the longest period of an inverted yield curve--short-term rates above long-term rates—since the 1980s. The graph below shows the difference between the yield on the 2-year Treasury bond and the 10-year. Before the most recent inversion, which began in July 2022, the yield curve has been upward sloping about 87% of the time. Moreover. The most recent inversion has had the longest duration observed in nearly 50 years, at more than 18 months.

However, after reaching a maximum inversion of -107 basis points in March 2023, the curve has steadily been steepening. As of July 31, the difference between the 2-year and 10-year yields had compressed to single digits.

There are several reasons the slope of the yield curve is such an important market signal. First, inverted yield curves have historically signaled an upcoming recession. The chart above shows this pattern, with each inversion other than the current one, being followed by a recession, as indicated by the shaded vertical bars. If a recession does not occur in 2024 or 2025, it will be an extraordinary exception to the rule. While some market forecasters are predicting a recession in the near future, in actual fact, most of the indicators of economic activity are strong. It remains to be seen whether a recession will occur in the near term, but we are clearly observing anomalous economic signals.

Second, inverted yield curves tend to put significant stress on the financial system. To over-simplify, banks and other financial intermediaries make profits by borrowing at low interest rates on a short-term basis, and lending or investing at higher rates on a longer-term basis. An inverted yield curve makes this basic business function much harder to achieve, and so makes it harder for financial institutions to provide credit and liquidity to non-financial businesses and households. One of the mysteries of the last several years, however, is that liquidity and credit conditions do not seem to be particularly stressed despite the extended yield curve inversion.

What does seem likely at this point is that the yield curve will continue to steepen, and by the end of 2024 and into 2025 we believe long-term yields will exceed short term yields as is the historic norm. This is especially true if the Fed begins to lower the overnight Federal Fund rate, as many are predicting. In other words, even if the Fed cuts the short-term rate it controls directly, the medium and long-term rates that are most significant for real economic activity—business investment, housing, and so on—are likely to rise. Investors and other market participants who are looking to the Fed to rescue them are likely to be disappointed if the yield curve continues to steepen, as we believe it will.

Inflation

Most broad measures of inflation have come down sharply from the peaks observed in 2022. The Consumer Price Index (CPI) reached a peak of 9.1% annual increase in June 2022, and as of now is trending around 3%. This is still above the Fed’s stated 2% target, but there are numerous other measures on inflation the Fed considers. Some of those are higher and some are lower than the CPI, but overall, it is clear that across much of the economy prices are not rising as rapidly as they had been 24 months ago.

Consumer Price Index Year-over-Year Percent Change

Source: Bloomberg, LP

However, a recent story in the Wall Street Journal describes a much more complex picture of the stress many businesses and households are feeling from high and still increasing prices for many goods and services. The article states:

[T]he overall pace of year-over-year inflation as measured by the Labor Department’s consumer-price index was down to 3% in its most recent reading—much, much lower than the recent high of 9.1% that it clocked two years ago.

But prices for many of the things that are hard to do without are still posting eye-watering increases. Rent and electricity bills are up 10% or more over the past two years, and car-insurance costs are up nearly 40%, according to the Labor Department’s index. Shoppers might be able to trade down from prime steak to cheaper cuts of meat at the supermarket, but they can’t really do the same thing with the water bill.[2]

This highlights the fact that there is no single measure of “inflation” that captures the complex and widely variable effects of higher prices on households and businesses. Broad measures such as CPI, are at best an approximation that aggregates and averages prices for hundreds of products and services, some of which may be rising, while others are stable or even falling.

In addition, the effects of even modest inflation varies greatly depending on the resources available to individual consumers and businesses to absorb higher prices. Another recent WSJ piece noted this discrepancy:

The third year of America’s inflation fight is widening a split at the heart of the economy.

The stock market is soaring, household wealth is at record levels and investment income has never been greater. At the same time, some families’ pandemic-era savings are running dry, and delinquencies on credit card and auto-loan payments have jumped.

Warning signals are flashing for more low- and middle-income Americans, exposing a division between people whose gains are being whittled down by elevated inflation and borrowing costs and those who are benefiting from high asset prices and bond returns. The crosscurrents are scrambling the outlook for the U.S. consumer—a bedrock of economic growth, corporate business plans and Wall Street investments…

Wage gains have kept full-time workers’ weekly median earnings roughly steady since early 2020, when taking price hikes into account, according to the Labor Department. But Lewis and many others who have earned raises say they are still fighting their way back from the initial inflationary shock after the pandemic hit.

Middle- and lower-income Americans generally faced faster inflation than the affluent from 2006 to 2023, according to a Labor Department analysis, thanks in large part to housing and insurance prices.[3]

The hard reality is that sustained inflation is an extraordinarily destructive force for any economy and society. The inflation the US and other Western countries have been experiencing has a wide range of causes and will be very difficult to eradicate and remediate completely, if that is even possible. But one thing is certain: It is far too early to declare victory.

International Considerations

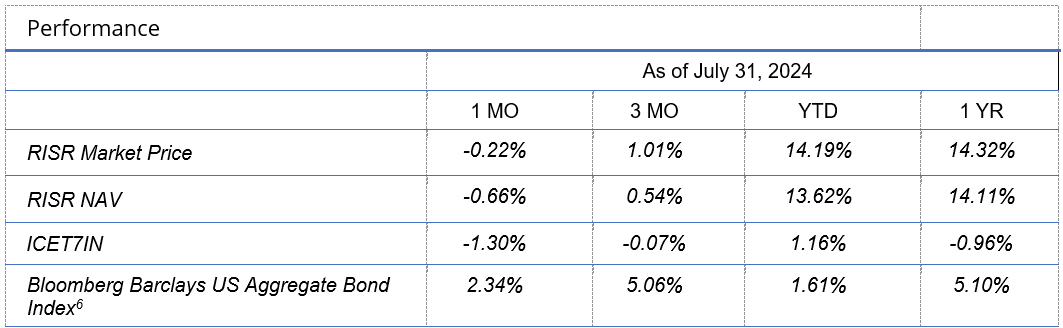

Everyone is, of course, aware of the ongoing military conflicts underway around the globe, most notably those in Ukraine and the Middle East. Another phenomenon that has not received nearly the same attention, although it is far more significant for financial markets, has been the relentless decline on the foreign exchange value of the Japanese Yen since the beginning of 2021. In that time, the value of the Yen vs the US Dollar declined by some 55%.

The chart below shows the rapid decline in the value of the Yen from around 100/USD to 162/USD as of mid-July, which was the weakest level since 1990.

For years, the Japanese Central Bank had been keeping its interest rates near zero for a variety of domestic policy reasons. This prompted something called the “Yen-Carry Trade.” In short, global investors would borrow Yen at a very low interest cost, and then convert those Yen into some other currency that could be invested at higher yields.

In response to the rapid decline in its exchange rate, the Japanese Central Bank on July 31, increased its benchmark interest rate by 25 basis points, and announced other measures intended to support the Yen vs other currencies. This triggered a very sharp negative reaction in markets around the globe, as traders sought to unwind the Yen Carry Trade. Over the following handful of days US equity markets declined by 8-10%, with some sectors falling much more sharply.

Since then, the Yen has appreciated a bit, but markets remain unsettled. Western central banks traditionally take the position (in public, anyway) that exchange rates are the purview of their respective Treasuries. By explicitly linking interest rate policy to the foreign exchange value of the Yen, Japan’s central bank threw a decided “curve ball” into financial markets, and the effects of that policy and other decisions it has indicated are under consideration are likely to be felt for some time to come.

US Elections

Finally, there was a bombshell announcement that President Joe Biden would be stepping out of the campaign for re-election following an abysmal debate performance against Donald Trump, and unavoidable questions about his fitness for office. As of this writing current Vice President Kamala Harris appears to have secured the Democratic candidacy. All prior predictions about the election in November have been thrown out the window.

In sum, there is a great deal of uncertainty weighing on financial markets. Volatility has reached near record highs, with the equity volatility VIX index spiking to levels not seen since the financial crisis of 2008. The MOVE index that measures bond market volatility also reached highs not seen for years. In the current environment, we believe it is extremely important for investors to keep a very close eye on risk in their investment portfolios.

Please contact us to explore how RISR might fit into your overall strategy, to help you manage risk while generating an attractive current yield.

[2] “Inflation Hurts Most for the Things We Can’t Skimp On,” WSJ August 12, 2024.

[3] “The Haves and Have-Nots at the Center of America’s Inflation Fight.” WSJ July 30, 2024

Portfolio Applications

We believe RISR provides an attractive, thematic strategy that provides strong correlation benefits for both fixed income and equity portfolios. It can be utilized as part of a core holding for diversified portfolios or as an overlay to manage the interest rate risk of fixed income portfolios. Alternatively, RISR can be used as a macro hedge against rising interest rates with less exposure to equity beta and negative correlation to fixed income beta. The underlying bonds are all U.S. agency credit that are guaranteed by FNMA, FHLMC or GNMA. Also, timing is on our side as the strategy generates current income if interest rates were to remain within a trading range.

Please contact us to explore how RISR can be utilized as a unique tool to adjust your portfolio allocations in the current inflationary environment.

| Yung Lim | Dean Smith | George Lucaci |

|---|---|---|

| Chief Executive Officer | Chief Strategist and Marketing Officer | Global Head of Distribution |

| Chief Investment Officer | RISR Portfolio Manager | |

| ylim@foliobeyond.com | dsmith@foliobeyond.com | glucaci@foliobeyond.com |

| 917-892-9075 | 914-523-2180 | 908-723-3372 |

This material must be preceded or accompanied by a prospectus. For a copy of the prospectus please click here.

Investments involve risk. Principal loss is possible. Unlike mutual funds, ETFs trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge fund risks. The value of MBS IOs is more volatile than other types of mortgage related securities. They are very sensitive not only to declining interest rates, but also to the rate of prepayments. MBS IOs involve the risk that borrowers default on their mortgage obligations or the guarantees underlying the mortgage-backed securities will default or otherwise fail and that, during periods of falling interest rates, mortgage-backed securities will be called or prepaid, which result in the Fund having to reinvest proceeds in other investments at a lower interest rate.

The Fund’s derivative investments have risks, including the imperfect correlation between the value of such instruments and the underlying assets or index; the loss of principal, including the potential loss of amounts greater than the initial amount invested in the derivative instrument. The value of the Fund’s investments in fixed income securities (not including MBS IOs) will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned indirectly by the Fund. Please see the prospectus for a complete description of principal risks.

Diversification does not eliminate the risk of experiencing investment losses.

Index Definitions

Bloomberg Barclays US Aggregate Bond Index: A broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

US Treasury 7-10 Yr Bond Inversed Index: ICE U.S. Treasury 7-10 Year Bond 1X Inverse Index is designed to provide the inverse of the daily return of the ICE U.S. Treasury 7-10 Year Bond Index (IDCOT7). ICE U.S. Treasury 7-10 Year Bond Index tracks the performance of US dollar denominated sovereign debt publicly issued by the US government in its domestic market. Qualifying securities of the underlying index must have greater than or equal to seven years and less than 10 years remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and an adjusted amount outstanding of at least $300 million.

S&P 500 Index: The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

IBOXHY Index: iBoxx USD Liquid High Yield Total Return Index measures the USD denominated, sub-investment grade, corporate bond market. The index includes bonds with minimum 1 years to maturity,

minimum amount outstanding of USD 400 mil. Bond type includes fixed-coupon, step-up, bonds with

sinking funds, medium term notes, callable and putable bonds.

Definitions

Alpha: a return achieved above and beyond the return of a benchmark or proxy with a similar risk level.

Annualized Equivalent Yield: represents the annualized yield based on the most recent month of income distribution: (income distribution x 12 months)/price per share.

Basis Points (bps): Is a unit of measure used in quoting yields, changes in yields or differences between yields. One basis point is equal to 0.01%, or one one-hundredth of a percent of yield and 100 basis points equals 1%.

Beta measures: the volatility of a security or portfolio relative to an index. Less than one means lower volatility than the index; more than one means greater volatility.

Convexity: A measure of how the duration of a bond changes in correlation to an interest rate change. The greater the convexity of a bond the greater the exposure of interest rate risk to the portfolio.

Correlation: a statistic that measures the degree to which two securities move in relation to each other.

Coupon: is the annual interest rate paid on a bond, expressed as a percentage of the bond’s face value.

CUSIP: An identifier number that stands for the Committee on Uniform Securities Identification Procedures assigned to stocks and registered bonds in the United States and Canada.

Duration: measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

GNMA: Government National Mortgage Association

FNMA: Federal National Mortgage Association

FHLMC: Federal Home Loan Mortgage Corporation

Short Investment (Shorting): is a position that has been sold with the expectation that it will decrease in value, the intention being to repurchase it later at a lower price.

Distributed by Foreside Fund Services, LLC.