RISR Commentary for May 2023

Click here for a pdf version of this commentary.

Performance Summary

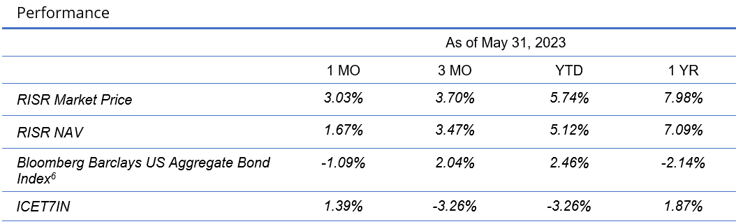

The FolioBeyond Rising Rates ETF (ticker: RISR) returned 3.03% based on the closing market price (1.67 % based on net asset value or “NAV”) in May. In comparison, the ICET7IN Index (US Treasury 7-Year Bond Inversed Index) returned 1.39% while the Bloomberg Barclays U.S. Aggregate Bond Index ("AGG") returned -1.09% during the same period.

The increase in May continued a generally favorable trend that began in mid-March. Despite considerable volatility, that reflects the most volatile rate environment in decades, RISR has climbed to within 2% of the most recent high of November 2022.

On May 3, the Federal Reserve raised the Fed Funds target rate by 25 bps, as had been widely expected. What many did not expect was that in response to that action, and other news, the yield curve inverted further, bringing the 2s10s spread to back down to -75 bps by month end, from the -50 bps range that had held since mid-March. The current inversion is the longest—and by far the largest—since the early 1980s. The reason for the current state of the curve seems to be the persistent belief among investors that the rate actions the Fed has taken will lead to a recession, despite the fact that many important indicators remain strong. In particular, the ongoing strength in the labor market is defying expectations, including among members of the Federal Reserve Board members. The widely followed Nonfarm Payroll report came in at 253 thousand, far above the 185 thousand that was forecast.

Name Change

We announced last month an upcoming name change for the fund. When we launched RISR in October of 2021, we were strongly convinced that interest rates were going to rise materially and quickly. The financial repression that policy makers in the US and the euro-zone had engineered for decades had run its course, and we perceived the emergence of a new regime of a more normalized environment. While few would admit it publicly, policy makers were forced to acknowledge that ZIRP (zero interest rate policy) had been a historic error, that had inflated asset prices and caused massive distortions in resource allocation and wealth distributions. And beginning in 2021 it led to the most serious inflation in 40 years.

Consistent with that belief, and to communicate our conviction to investors, we elected to name the fund the Rising Rates ETF. Performance in 2022 and continuing so far into 2023 has validated our outlook. We always recognized, however, that this strategy had benefits far beyond a simple bet on higher interest rates. We understood from the beginning, that our ability to deliver a negative duration profile, low correlation to traditional strategies together with an attractive rate of current income should have appeal to a broad range of investors and investment advisors.

To that end, we have made the decision to change the name of the fund to the “FolioBeyond Alternative Income and Interest Rate Hedge ETF.” The name change will become effective on June 26. We are keeping the RISR ticker.

We believe this name change better reflects the utility of our strategy to a broader audience, beyond those who take a directional view on interest rates. We always discussed these benefits in direct conversations with investors, but the name change makes it clear that we intend for this fund to deliver benefits to investors looking to prudently manage risk, regardless of the general direction of rates. No matter what your view on future Federal Reserve policy might be, we think everyone can agree that managing risk is a smart thing to do. We intend to make it even more clear that RISR can be a useful tool in that process. If you have questions about this change, please contact us.

Outlook

As noted above, the last several quarters have been some of the most volatile for interest rates the market has seen in quite some time.

Source: Bloomberg, LP (“20-day vol” is the standard deviation of daily rate changes over the prior 20 business days.)

This volatility, as well as the general upward trend in rates, has led to significant stress in the financial system. This is especially true for poorly managed banks, including some recent casualties including, notably, Silicon Valley Bank and Republic Bank. According to several news sources, the FDIC’s confidential “troubled bank list” currently includes more than 170 institutions, an increase of around 50% since the beginning of the year. Not all of these are imminently likely to fail, but it is a clear indication that the financial sector is struggling. And the problem is not limited to the U.S. UBS recently had to take over a deeply troubled Credit Suisse in a “shotgun marriage” arranged by the Swiss government.

Of more concern is that these challenges are arising in what is otherwise a reasonably resilient economy. The tech sector and the housing market have clearly been challenged, but the stock market is strong, unemployment is low, and businesses are reporting solid earnings. One has to wonder how the banking system will hold up if the long awaited, much predicted recession actually arrives.

Interestingly, we have been having an increasing number of discussions with institutions and advisors asking how they can use RISR as part of their overall risk management plans. While it would have been better for folks to be asking such questions a year ago, we welcome the renewed attention to risk management we are sensing from these conversations and other sources. For decades (with the obvious interruption of the financial crisis of 2007-09), running a bank has been pretty simple. Interest rates fell steadily since 1981, and there was a naïve belief that we had conquered the business cycle. They even came up with a name for it—the “Great Moderation.”

That phrase is seldom heard these days. There is a growing appreciation that we have entered a new regime, one in which volatility and risk will loom large. People are recalling Warren Buffet’s most iconic piece of investment advice: “Rule No. 1 is never lose money. Rule No. 2 is never forget Rule No. 1. While such a rule is easier to state than to always adhere to, we think the growing attention to risk is likely to persist in a world and market that seems ever more uncertain.

It is for this reason we designed RISR to have broad appeal to a range of investors, who share with us a belief in the wisdom of prudently managing risk. RISR can help in that effort, offering a low correlation to many key market sectors, together with a high current dividend.

Please contact us to explore how RISR might fit into your overall strategy, to help you manage risk while generating an attractive current yield.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling 866-497-4963. Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Returns beyond 1 year are annualized.

A fund's NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the fund was traded. The fund intends to pay out income, if any, monthly. There is no guarantee these distributions will be made.

Total Expense Ratio is 0.99%.

For standardized performance click here

Portfolio Applications

We believe RISR provides an attractive, thematic strategy that provides strong correlation benefits for both fixed income and equity portfolios. It can be utilized as part of a core holding for diversified portfolios or as an overlay to manage the interest rate risk of fixed income portfolios. Alternatively, RISR can be used as a macro hedge against rising interest rates with less exposure to equity beta and negative correlation to fixed income beta. The underlying bonds are all U.S. agency credit that are guaranteed by FNMA, FHLMC or GNMA. There is no financing leverage or explicit short positions that relies on borrowed securities. Also, timing is on our side as the strategy generates current income if interest rates were to remain within a trading range.

Please contact us to explore how RISR can be utilized as a unique tool to adjust your portfolio allocations in the current inflationary environment.

| Yung Lim | Dean Smith | George Lucaci |

|---|---|---|

| Chief Executive Officer | Chief Strategist and Marketing Officer | Global Head of Distribution |

| Chief Investment Officer | RISR Portfolio Manager | |

| ylim@foliobeyond.com | dsmith@foliobeyond.com | glucaci@foliobeyond.com |

| 917-892-9075 | 914-523-2180 | 908-723-3372 |

This material must be preceded or accompanied by a prospectus. For a copy of the prospectus please click here.

Investments involve risk. Principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge fund risks. The value of MBS IOs is more volatile than other types of mortgage related securities. They are very sensitive not only to declining interest rates, but also to the rate of prepayments. MBS IOs involve the risk that borrowers may default on their mortgage obligations or the guarantees underlying the mortgage-backed securities will default or otherwise fail and that, during periods of falling interest rates, mortgage-backed securities will be called or prepaid, which may result in the Fund having to reinvest proceeds in other investments at a lower interest rate.

The Fund’s derivative investments have risks, including the imperfect correlation between the value of such instruments and the underlying assets or index; the loss of principal, including the potential loss of amounts greater than the initial amount invested in the derivative instrument. The value of the Fund’s investments in fixed income securities (not including MBS IOs) will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned indirectly by the Fund. Please see the prospectus for a complete description of principal risks.

Diversification does not eliminate the risk of experiencing investment losses.

Index Definitions

Bloomberg Barclays US Aggregate Bond Index: A broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

US Treasury 7-10 Yr Bond Inversed Index: ICE U.S. Treasury 7-10 Year Bond 1X Inverse Index is designed to provide the inverse of the daily return of the ICE U.S. Treasury 7-10 Year Bond Index (IDCOT7). ICE U.S. Treasury 7-10 Year Bond Index tracks the performance of US dollar denominated sovereign debt publicly issued by the US government in its domestic market. Qualifying securities of the underlying index must have greater than or equal to seven years and less than 10 years remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and an adjusted amount outstanding of at least $300 million.

S&P 500 Index: The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

IBOXHY Index: iBoxx USD Liquid High Yield Total Return Index measures the USD denominated, sub-investment grade, corporate bond market. The index includes bonds with minimum 1 years to maturity,

minimum amount outstanding of USD 400 mil. Bond type includes fixed-coupon, step-up, bonds with

sinking funds, medium term notes, callable and putable bonds.

Definitions

Alpha: a return achieved above and beyond the return of a benchmark or proxy with a similar risk level.

Annualized Equivalent Yield: represents the annualized yield based on the most recent month of income distribution: (income distribution x 12 months)/price per share.

Basis Points (bps): Is a unit of measure used in quoting yields, changes in yields or differences between yields. One basis point is equal to 0.01%, or one one-hundredth of a percent of yield and 100 basis points equals 1%.

Beta measures: the volatility of a security or portfolio relative to an index. Less than one means lower volatility than the index; more than one means greater volatility.

Coupon: is the annual interest rate paid on a bond, expressed as a percentage of the bond’s face value.

Correlation: a statistic that measures the degree to which two securities move in relation to each other.

Convexity: A measure of how the duration of a bond changes in correlation to an interest rate change. The greater the convexity of a bond the greater the exposure of interest rate risk to the portfolio.

CUSIP: An identifier number that stands for the Committee on Uniform Securities Identification Procedures assigned to stocks and registered bonds in the United States and Canada.

Duration: measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

GNMA: Government National Mortgage Association

FNMA: Federal National Mortgage Association

FHLMC: Federal Home Loan Mortgage Corporation

Short Investment (Shorting): is a position that has been sold with the expectation that it will decrease in value, the intention being to repurchase it later at a lower price.

Distributed by Foreside Fund Services, LLC.