RISR Commentary for December 2022

Performance Summary

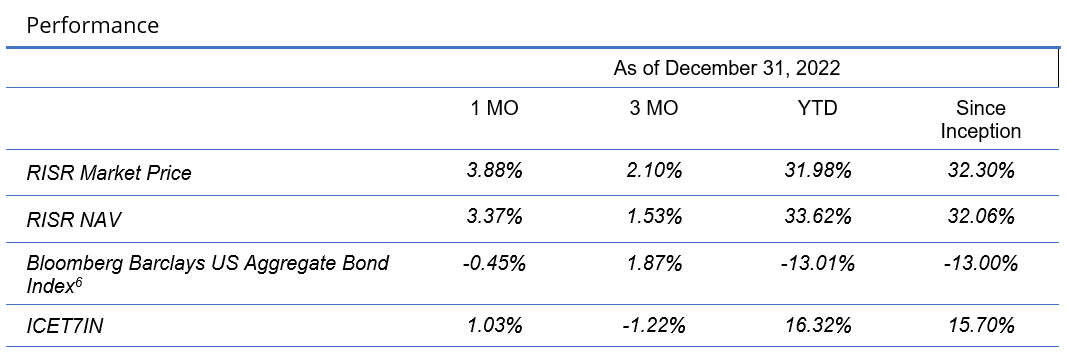

The FolioBeyond Rising Rates ETF (ticker: RISR) returned 3.89% based on the closing market price (3.37% based on net asset value or “NAV”) in December, which brought the full-year 2022 performance to 31.97%, and 33.62% based on NAV. In comparison, the ICET7IN Index (U.S. Treasury 7-Year Bond Inversed Index) returned 1.03% while the Bloomberg Barclays U.S. Aggregate Bond Index ("AGG") returned -0.45% during the same period. The see-saw performance we observed all year in interest rates continued in December, with the 10-year moving from an intra-month low of 3.42%, to close the month and the year at 3.88%. While this is still well below the full-year high of about 4.25% seen in October, it is well above the summer rally lows of 2.58%.

This performance placed RISR in an extremely small cohort of domestic bond ETFs that produced positive performance in 2022. Moreover, we delivered this performance without taking corporate credit risk, without using leverage to enhance returns, and without the use of OTC derivatives. Our unique strategy performed exactly as intended, and delivered returns that were geared to a rising rate environment, while offering diversification and comparatively low volatility.

We also elected to make a special dividend distribution in December, that bumped our stabilized rate of $0.18/share to a one-time payment of $0.24/share. We anticipate returning to the stabilized rate in January and going forward.

The economic environment in 2022 was affected by a wide range of global and domestic forces, many of which worked in opposition to each other. The most significant policy impacts clearly came from the aggressive—albeit belated—increases in interest rates engineered by the Federal Reserve in an attempt to bring down inflation. After nonchalantly watching inflation escalate alarmingly throughout 2021, the Fed finally took action in March of this year.

The first two rate hikes of 25 bps, had essentially no impact, and so by mid-year, the Fed was forced to undertake an unprecedented series of 75 bps hikes that ultimately increased the Fed Funds target by 425 bps rate over a nine month cycle. By the Fed’s own public disclosure, it is more likely than not they will have to raise rates further in 2023.

Exacerbating the Fed’s dilemma was a long-time-in-the-making global supply chain bottleneck. For much of 2022, major maritime ports worldwide were shut down or operating at severely diminished capacity due to a lack of operating capacity and staffing. These constraints affected supplies of virtually the whole macro-economy, but were especially impactful on manufactured goods that depend on computer micro-processors (chips). In other words, virtually everything.

A third adverse factor was the ongoing war in Ukraine. Whatever expectations Russia may have initially had for a swift capitulation, those hopes were dashed by the strong resistance put up by the Ukrainian military—assisted of course, by a massive inflow of military, diplomatic and financial support from the US and its NATO allies. As of today, there is still no resolution in sight for that conflict, and so the pressures on food supplies, energy, and other commodities we saw in 2022 will likely persist.

A fourth confounding factor was the surprisingly persistent strength in the US labor market. For a variety of reasons, many connected to Covid, labor participation rates in the US have continued their steady decline, and show no sign of reversing. This has led to a very tight labor supply, as employers searched fruitlessly for workers to restaff operations recovering from the shutdown and restrictions from 2020 and 2021. In fact, despite the Fed’s rate hikes, 2022 ended with a lower unemployment rate than at the start of the year.

As 2022 drew to a close, several of these factors were beginning to show signs of softening, with energy prices coming down sharply from their mid-year highs. Oil prices that had topped $120/bbl., ended the year around $75/bbl. That is still well above the long-term average of around $62/bbl. from 2000-2019.

Used car prices, which had skyrocketed under the pressure of Covid-induced supply constraints for new cars, also came down sharply.

In addition, the stock market had its worst year in many years, with big tech leading the way down, as it had during the prior 15 years on the way up.

Finally, a series of substantial layoffs totaling hundreds of thousands of workers in tech, finance, real estate, and even food businesses occurred in the latter half of the year, and many more are announced or expected for 2023.

To sum up, 2022 saw:

a rapid escalation of inflation

a belated and initially halting but ultimately aggressive Fed effort to tighten market conditions

a series of persistent supply constraints related to lingering Covid issues, and the war in Ukraine

a remarkably resilient labor market due to not-well-understood changes to labor force participation rates

an extremely challenging market for financial assets of all kinds, as well as real estate, where essentially nothing worked for investors (RISR excepted)

a very tentative and debatable slowdown in some sectors near the end of the year.

So, what happens next for the economy, the markets and RISR?

Outlook

Throughout the 4th quarter of 2022, numerous Fed officials, speaking in a variety of formats, attempted to assure the markets that they intend to stay the course with respect to higher rates, for as long as it takes to bring inflation down to their 2% target. They were forced to do this because they lacked credibility with market participants.

The dominant themes among market commentators have been running along the following viewpoints:

The Fed has already won. Inflation has peaked and will begin falling rapidly in 2023.

Regardless of whether inflation drops from its currently elevated level, the Fed lacks the institutional courage to fight investors in financial assets. They will end their rate hikes sooner than later and will “pivot” to a more dovish stance, similar to the “taper tantrum” of 2013.

A recession is worse than inflation, and when unemployment begins to rise, the Fed will blink and cut rates to avoid a sharp downturn. Inflation will once again take a back-seat to maintaining full employment.

In our view, all of these outlooks are mistaken. The mixed messaging and diverse communications from Fed backbenchers have largely disappeared. There has been near unanimity among spokespeople in recent months, led by Chair Jay Powell, but increasingly from formerly more dovish voices, including Minneapolis Fed president Kashkari. If anything, Fed communications have become even more hawkish in recent weeks, as the markets have pushed back, and investors have resumed a more risk-on posture.

While we don’t expect to see another 425 bps increase in Fed Funds this year, we firmly believe the higher-for-longer rate outlook is the smart money bet. With all of the uncertainty around policy and geopolitics, it is likely that markets in 2023 will continue to experience elevated levels of volatility. In that environment, we believe prudent investors ought to look to manage risk by reducing duration, and looking for ways to generate current income. Positioning for a big bullish pivot in risk assets seems reckless in our view.

One of the main reasons for this conservative outlook remains the deeply inverted yield curve. We have shown the chart below in the past, but it is worth discussing again.

This graph plots the difference between the 10-year UST yield and the 2-year UST yield. It currently stands at -0.66%, which is the most inverted[3] the yield curve has been since the 1980s. Why is this problematic?

Put simply, the financial system in a modern economy requires that intermediaries such as banks and other lenders be able to earn a positive return on the loans they extend to their customers. Those are loans funded with deposits and other short-term liabilities they issue. When short-term rates are above long-term rates, the cost of funds for these banks can exceed the return they earn on the loans they make to consumer and commercial borrowers. Inflation exacerbates this problem, because over time, it reduces the real value of the repayments they receive from the maturing loans.

In short, in order for inflation to come back down to the Fed’s targets, and a healthy financial market to be restored, the yield curve must re-steepen. There has never been a case where that has not occurred. We do not think basic fundamental macro-economic laws have been repealed. For that reason, we foresee ongoing volatility in rates, commodities, real estate and stocks. Already, the largest banks have signaled that earnings will come under significant pressure in the near term. According to the Wall Street Journal, “America’s biggest lenders are expected to post $28 billion in fourth-quarter [2022] profits, down 15% from a year earlier.”[4]

Consequently, it makes sense to maintain a cautious outlook into 2023. Even if the Fed decides to slow the pace of their rate hikes from the rapid rises in 2022, that should not be taken as an “all clear” to pile back into risk assets.

We designed RISR to have broad appeal to a range of investors, including those who have a more sanguine view, than ours, but who also agree with the wisdom of prudently managing risk. RISR can help in that effort, offering a low correlation to many key market sectors, together with a high current dividend income.

Please contact us to explore how RISR might fit into your overall strategy, to help you manage risk while generating an attractive current yield.

Inception date: 09/30/2021

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling 866-497-4963. Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Returns beyond 1 year are annualized.

A fund's NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the fund was traded. The fund intends to pay out income, if any, monthly. There is no guarantee these distributions will be made.

Total Expense Ratio is 1.01%.

Portfolio Applications

We believe RISR provides an attractive, thematic strategy that provide strong correlation benefits for both fixed income and equity portfolios. It can be utilized as part of a core holding for diversified portfolios or as an overlay to manage the interest rate risk of fixed income portfolios. Alternatively, RISR can be used as a macro hedge against rising interest rates with less exposure to equity beta and negative correlation to fixed income beta. The underlying bonds are all U.S. agency credit that are guaranteed by FNMA, FHLMC or GNMA. There is no financing leverage or explicit short positions that relies on borrowed securities. Also, timing is on our side as the strategy generates current income if interest rates were to remain within a trading range.

Please contact us to explore how RISR can be utilized as a unique tool to adjust your portfolio allocations in the current inflationary environment.

| Yung Lim | Dean Smith | George Lucaci |

|---|---|---|

| Chief Executive Officer | Chief Strategist and Marketing Officer | Global Head of Distribution |

| Chief Investment Officer | RISR Portfolio Manager | |

| ylim@foliobeyond.com | dsmith@foliobeyond.com | glucaci@foliobeyond.com |

| 917-892-9075 | 914-523-2180 | 908-723-3372 |

This material must be preceded or accompanied by a prospectus. For a copy of the prospectus please click here.

Footnotes:

[1] Source: Bloomberg, L.P. n.b. “CPI YOY % change” is through November 2022

[2] Source: Bloomberg, L.P.

[3] Normally, long-term interest rates are higher than short term rates. The yield curve is said to be “inverted” when the opposite relationship holds.

[4] https://www.wsj.com/articles/bank-earnings-put-u-s-economy-under-microscope-11673322214

Investments involve risk. Principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge fund risks. The value of MBS IOs is more volatile than other types of mortgage related securities. They are very sensitive not only to declining interest rates, but also to the rate of prepayments. MBS IOs involve the risk that borrowers may default on their mortgage obligations or the guarantees underlying the mortgage-backed securities will default or otherwise fail and that, during periods of falling interest rates, mortgage-backed securities will be called or prepaid, which may result in the Fund having to reinvest proceeds in other investments at a lower interest rate.

The Fund’s derivative investments have risks, including the imperfect correlation between the value of such instruments and the underlying assets or index; the loss of principal, including the potential loss of amounts greater than the initial amount invested in the derivative instrument. The value of the Fund’s investments in fixed income securities (not including MBS IOs) will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned indirectly by the Fund. Please see the prospectus for a complete description of principal risks.

To view a full list of holdings, including the fund’s top 10 holdings, click here.

Diversification does not eliminate the risk of experiencing investment losses.

Index Definitions

Bloomberg Barclays US Aggregate Bond Index: A broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

US Treasury 7-10 Yr Bond Inversed Index: ICE U.S. Treasury 7-10 Year Bond 1X Inverse Index is designed to provide the inverse of the daily return of the ICE U.S. Treasury 7-10 Year Bond Index (IDCOT7). ICE U.S. Treasury 7-10 Year Bond Index tracks the performance of US dollar denominated sovereign debt publicly issued by the US government in its domestic market. Qualifying securities of the underlying index must have greater than or equal to seven years and less than 10 years remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and an adjusted amount outstanding of at least $300 million.

S&P 500 Index: The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

IBOXHY Index: iBoxx USD Liquid High Yield Total Return Index measures the USD denominated, sub-investment grade, corporate bond market. The index includes bonds with minimum 1 years to maturity, minimum amount outstanding of USD 400 mil. Bond type includes fixed-coupon, step-up, bonds with sinking funds, medium term notes, callable and putable bonds.

Definitions

Alpha: a return achieved above and beyond the return of a benchmark or proxy with a similar risk level.

Annualized Equivalent Yield: represents the annualized yield based on the most recent month of income distribution : (income distribution x 12 months)/price per share.

Basis Points (bps): Is a unit of measure used in quoting yields, changes in yields or differences between yields. One basis point is equal to 0.01%, or one one-hundredth of a percent of yield and 100 basis points equals 1%.

Beta measures: the volatility of a security or portfolio relative to an index. Less than one means lower volatility than the index; more than one means greater volatility.

Coupon: is the annual interest rate paid on a bond, expressed as a percentage of the bond’s face value.

Correlation : a statistic that measures the degree to which two securities move in relation to each other.

Convexity: A measure of how the duration of a bond changes in correlation to an interest rate change. The greater the convexity of a bond the greater the exposure of interest rate risk to the portfolio.

CPI: Consumer Price Index

CUSIP : An identifier number that stands for the Committee on Uniform Securities Identification Procedures assigned to stocks and registered bonds in the United States and Canada.

Duration: measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

GNMA: Government National Mortgage Association

FNMA: Federal National Mortgage Association

FHLMC: Federal Home Loan Mortgage Corporation

Short Investment (Shorting): is a position that has been sold with the expectation that it will decrease in value, the intention being to repurchase it later at a lower price.

YOY: Year-over-year

Distributed by Foreside Fund Services, LLC.